Jamie Dimon, JPMorgan Chase, Testifies

/Jamie Dimon, JPMorgan Chase's chairman and chief executive, testified before the Senate Banking Committee regarding losses that could balloon to $5 billion. Questions focused on whether the bank should have done more to stem risky derivative trades by the chief investment office. As a strong opponent of federal banking regulation, Dimon was on the hot seat about this perspective.

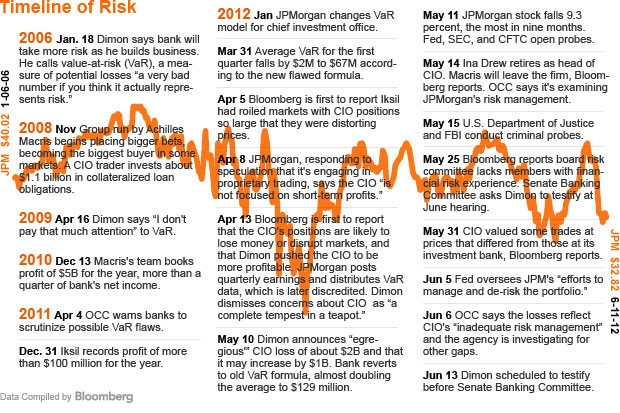

In advance of the testimony, BloombergBusinessWeek compiled this "Timeline of Risk," under the article title, "House of Dimon Marred by CEO Complacency Over Unit's Risk."

During the testimony, Dimon made several comments of particular interest to business communication students:

- He referred to the bank as having an "open kimono" with regulators. Dimon used this same odd, but common business expression on Meet the Press. Here's an interesting discussion of the phrase.

- "The American business machine is the best in the world." The New York Times DealBook calls this a "little burst of patriotism." It's a admirable attempt at emotional appeal.

- Jeff Merkley, a senator from Oregon, said that JPMorgan Chase was saved by the 2008 bailouts. According to DealBook, this was the first time Dimon got "testy." He replied, "You're factually wrong," to which Merkley said, "Let's agree to disagree." Business communication students may question what constitutes a "fact" in this disagreement.

Discussion Starters:

- What the entire video testimony. At what points is Jamie Dimon most and least convincing?

- What are the strongest and weakest lines of questioning by the senators?

- Overall, did Dimon's testimony strengthen or weaken JPMorgan Chase's credibility regarding the losses?